As a corporate renewable energy buyer, you have the difficult task of leading your company to make impactful, long-term investments in renewable energy projects while also mitigating exposure to financial and reputational risks. The team at LevelTen Energy is dedicated to helping you achieve these objectives by delivering unprecedented levels of access, transparency, and analytics into renewable energy markets and building the tools to streamline your decision-making process.

With this goal in mind, LevelTen is launching a series of reports meant to provide insight into the market dynamics, opportunities, and challenges of procuring renewable energy in each market represented on the LevelTen Marketplace. In this first report, we will examine the Midcontinent Independent System Operator (MISO) region. Please reach out to us if you'd like to learn more about how MISO projects can help your organization meet its sustainability goals.

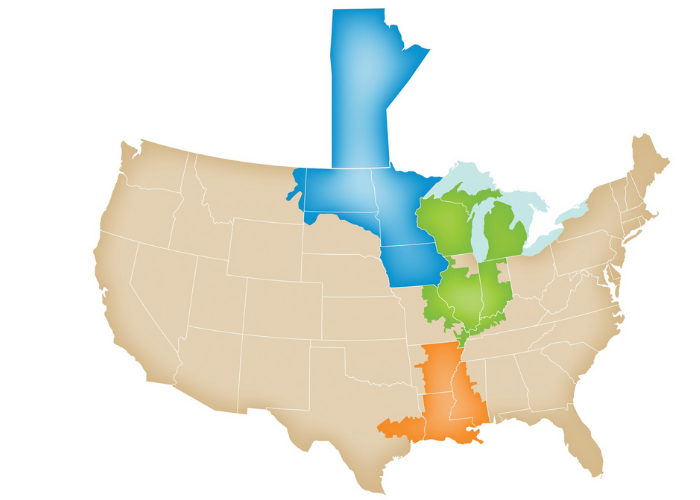

Geographical Overview

MISO is one of the world's largest energy markets, covering 15 states from North Dakota down to Louisiana, as well as the Canadian province of Manitoba. MISO maintains grid reliability and keeps the lights on by operating energy-only and reserves markets where buyers and sellers trade energy down to the five-minute interval.

PPA Prices in MISO

According to LevelTen's Q1 2020 PPA Price Index (full report coming soon!), PPA offer prices for both solar and wind projects rose quarter-over-quarter. The solar P25 index rose $1.6 per MWh, or 5.4%, compared to Q4 2019. This rise broke a streak of three consecutive quarters with declining prices. The wind P25 Index rose by 1.6%, or $0.43 cents per MWh, from last quarter.

On a year-over-year basis, MISO solar prices saw a 5.7% fall. Wind prices, on the other hand, are up a whopping 22.4% in the P25 index and 8.5% in the P50 index as the PTC phase down continues to take its toll. This is a continuation of the broader rising price trend playing out over the last year for wind PPAs.

MISO Settlement Values

Before going further, it's critical for buyers to recognize that when it comes to PPAs, price does not equal value. Virtual PPA (VPPA) transactions are structured as fixed-for-floating-swaps, which means that to understand your company's financial risk exposure when entering into a VPPA, what really matters is how the (fixed) PPA price compares to the (floating) wholesale market price of electricity. If the wholesale market price is higher than the fixed PPA price, the buyer receives the difference from the project. In other words, the VPPA settlement value is positive. On the other hand, if the wholesale market price is lower than the fixed PPA price, the buyer pays the difference to the project, and the PPA settlement value is negative (check out our VPPA 101 guide for more information).

While PPA offer prices from projects in MISO may be higher compared to PPA offer prices from projects in other ISOs, there are MISO projects that LevelTen expects would offer competitive, positive settlement value to prospective buyers. The figure below illustrates that LevelTen expects the net present settlement value ($/MWh) of projects in some MISO states to be as high as $7.00/MWh. The offers with the most positive settlement values tend to be from solar projects located in the Midwest and Southern MISO states, namely Indiana and Texas.

Settlement Value by Hub

The following chart illustrates the range of settlement values for the most common trading hubs in MISO, revealing where renewable energy assets are expected to capture the best value. Note, positive settlement values are found at Indiana Hub, Louisiana Hub and Texas Hub.

Understanding the Range of Projects in MISO

- Settlement Value by Tech: When looking at the difference in expected settlement value between solar and wind projects in the figure below, you see that solar projects outperform wind projects across the MISO region.

- Volume Offered: Through the LevelTen Marketplace, developers are able to offer smaller chunks of projects or entire projects. This chart shows the wide range of project volumes offered, from 100,000 MWh per year to over 500,000 MWh/year.

- Project Nameplate Capacity: Projects in MISO are sized between 40 MW and 300 MW, with an average size of just over 100 MW.

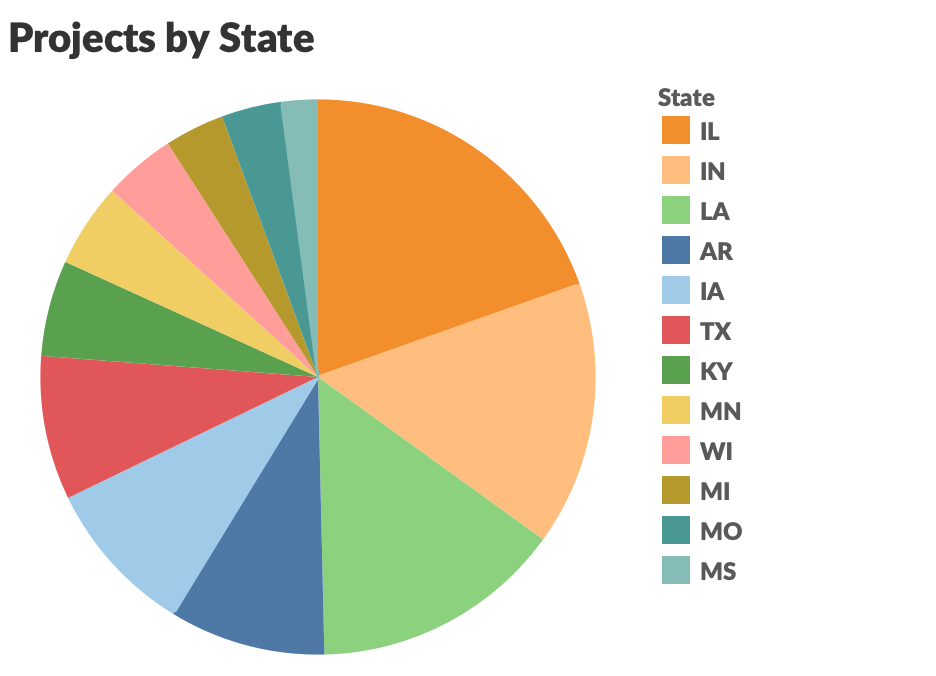

Active Projects Under Development in MISO

In MISO there is a robust supply of wind and solar projects that are actively updating their PPA offer prices on the LevelTen Marketplace.

The number of solar projects on the LevelTen Marketplace far outnumber that of wind.

When looking at the percentage of projects across states in the MISO region, Illinois has the largest while Mississippi has the fewest.

Corporate Procurement in MISO

According to the Renewable Energy Buyers Alliance's (REBA) recent analysis of corporate purchases by state, it appears buyers have overlooked sourcing from projects located in MISO compared to other ISOs. It is important to note that while the numbers in Illinois and Indiana are commendable (at 14 and 6, respectively), most of those transactions occurred in the PJM Interconnection portion of those states.

The Generation Mix

MISO has historically been one of the "dirtiest" grids in the United States due to its large fleet of coal generators. In 2005, electricity from coal represented over three-fourths of the total generation mix. Fortunately, lower natural gas prices and increased renewable energy development has driven the more-costly coal plants to retire. Even this past year natural gas generation has increased by over 35% this February when compared to a year ago.

Today, MISO's generation fleet is composed of 20,000 MW of wind and over 300 MW of solar. Iowa, in fact, has the second highest amount of installed wind capacity of any state (behind Texas) and the highest overall percentage of energy generated from wind in 2019. For perspective, wind alone made up around 10% of total supply in MISO last year while in the neighboring PJM grid, all renewables technologies combined totaled 5%.

MISO Interconnection Queue

MISO's generation mix is changing rapidly. A review of MISO's interconnection queue, which shows projects that have requested a connection to MISO's grid, reveals a large number of solar and wind projects are expected to be brought online in the coming years: there are 57 GW of solar projects alone in the MISO queue. A quick look at a map of MISO's interconnection queue shows just how many solar and wind projects MISO is studying for grid connection.

Carbon Emissions Reduction

Since MISO has a generation mix that is predominantly coal, supporting new renewable projects in MISO can have a larger impact displacing carbon dioxide equivalent (CO2e) emissions compared to other U.S. grids. The following figure shows the total carbon dioxide emissions in million metric tons from the electric power sector for each state, with states shaded darker red having higher emissions. Notably, some of the highest emitting states are in the MISO grid region.

The exact number of CO2 emissions displacement will depend on the project's location and technology. LevelTen's PPA Marketplace calculates CO2 emissions displaced for every active project using underlying data from EPA's publicly available Avoided Emissions and Generation Tool (AVERT).

Development Challenges

Though renewable energy project development is a difficult task in nearly all jurisdictions, there are specific challenges in MISO. With a large volume of projects requesting MISO grid connection, developers have experienced significant delays throughout the MISO interconnection study process. To alleviate some of these delays, MISO initiated an interconnection study reform process in 2016 intended to reduce the number of speculative projects requesting interconnection study and, therefore, accelerate the study of the "real" projects. Unfortunately, the reform process has had the unintended consequence of adding to the delays, and some projects have been stalled in the study queue for years.

As a corporate renewable energy buyer, it is critical that you consider project development risks when making PPA investment decisions. The last thing you want is for the project that you've spent months selecting, negotiating with, and aligning internal stakeholders around to fall through before reaching construction because the project failed to receive all necessary approvals. With decades of direct experience developing and constructing renewable energy projects, LevelTen's team is uniquely qualified to advise corporate buyers on development risk.

In the case of MISO, our approach is to track and understand the interconnection queue delays and focus efforts on projects that have cleared these hurdles. The good news is that MISO fully recognizes the interconnection queue challenges. In 2020 MISO has committed to working towards remedying the delays through a new initiative called Queue Enhancements (IR072). LevelTen experts are tracking the evolution of MISO's efforts in order to provide our customers with the most up-to-date guidance on project development risks.

Interested in a MISO PPA?

As a buyer, you can access real-time cashflow analyses of nearly every wind and solar project in North America through the LevelTen Marketplace to understand the value and risks associated with each PPA offer. With over one billion data points being processed daily on the Marketplace, LevelTen offers buyers a data-driven approach to renewable energy procurement. Reach out to a LevelTen representative today.

Download this Report

Fill out the form below to download a PDF of this report.

.png)